Who else thinks that schools should teach us how to budget money, how to manage our finances, and how to save money?

These are such important skills. But we usually only get a chance to learn about this through trial and error when we enter the adult world for the first time.

If you are a young professional, you might be overwhelmed by the idea of budget planning and money management. Even as a student you were exempt from paying tax and council tax and were given lots of discounts to help you through.

Starting out in the real world can be intimidating as you are having to make these extra payments on top of paying off student loans. Getting good at managing your money and living within your means is crucial. I remember getting my first paycheck and seeing that 1/3 of it was gone. Yikes! It hurt!

Equally, as an aspiring Girl Boss, you might have to invest some money into your entrepreneurial ideas. Therefore, planning your budget so that you have some money each month to invest in your venture is vital.

So with that in mind, I created a simple beginner guide that will help you plan, manage and get control of your finances…let’s jump right in and become finance savvy!

Disclaimer: This site contains affiliate links to products. We may receive a commission for purchases made through these links. Visit my disclaimer page for more information.

STEP 1: How to create a smart budget?

Add up combined income for your month post-tax.

If you only have one source of income, paid to you once monthly, then you are set. However, if you have multiple sources of income then add them up so you know your total monthly budget.

Next, you want to make a list of all your essential monthly expenses. These may include the following:

- Rent

- Bills: split up if makes it easier – gas, electricity, water, council tax, building, internet, phone contract

- Subscriptions: Amazon Prime, Netflix, Meal delivery…

- Credit cards payments

- Car cost – insurance, petrol

- Loans

- Other monthly costs

Calculate what you have left behind.

This is your budget. The payments above are necessary and you have no choice but to pay them. What is left behind is the money you can work with for the remainder of the month.

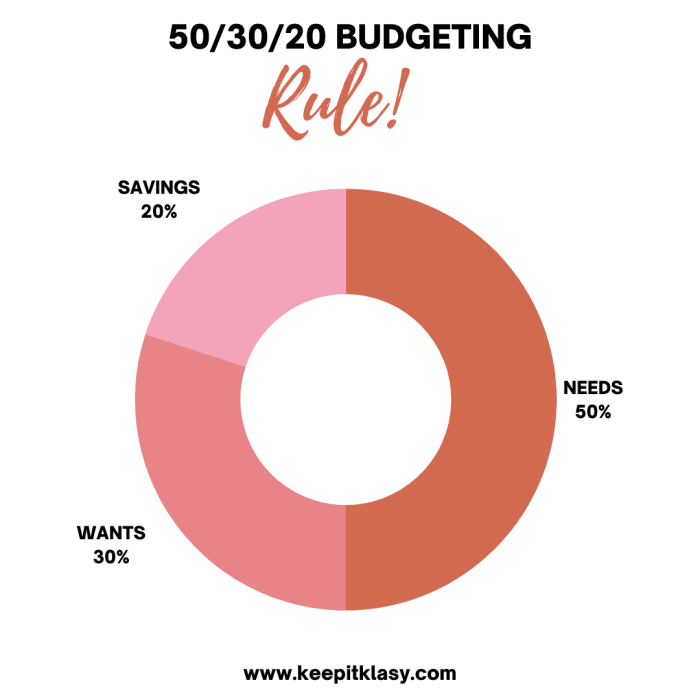

With the remainder of the money, you want to apply the 50/30/20 rule in how you split the remaining budget.

Your basic budget

50% = needs

30% = wants

20% = savings/investment

Some people apply the 50/30/20 rule before paying for essentials but essentials are essentials. You have already most likely committed to these so you can’t change them. You won’t be able to save on those right now. The rest you can control and budget money accordingly.

Place savings in a different bank account.

Depending on how much you earn you will have a little bit of money you can put aside each month. Even if small and seems insignificant to you, it all adds up.

This is where most people fail. They think that there is no point putting a small amount of money aside. But if you are on a low budget that £100 you saved last year, could help you out with any unexpected costs that arise.

If you save £10 a month for 5 years, you’ll have £600 in your bank account. That is not an insignificant amount of money.

As you progress through your career your income is likely to rise too. This amount could scale up very quickly if you are consistent.

To sum up – the importance of saving:

- Can act as an emergency fund.

- Will keep growing.

- Helps with unpredictable expenses.

Work out the amount per week

Right, so savings are safely put away in your savings account.

Divide ‘needs’ and ‘wants’ to work out what you would have per week.

- Needs / 4.34 = needs per week

- Want / 4.34 = wants per week

This is your weekly personal budget.

Doing this can help you decide how much money you have for your food budget or household expenses per week.

Do the same with your wants budget. If you have something planned for the weekend, then it helps figure out approximately how much money you can spend each weekend to stay within your monthly budget. This will allow you to manage your money in a sensible way. If you have an event in the 3rd week of the month you might want to have a low-key weekend before so you can enjoy and splurge more during the event.

Any money you do not spend in the week can go to the savings too ;).

STEP 2: Realistic evaluation of your budget.

Take charge of your finances!

It is uncomfortable looking at your finances, especially when you are not earning a huge amount. But facing it head-on and having a realistic idea of your spending will help you budget money wisely.

You’ve worked out your income and expenses. And you’ve figured out how much you have left behind each month. Now ask yourself:

Are you living within your means?

If not, work out if there is a way you could save money or cut down on some spending.

Evaluating your spending.

Look at your bank statement for the last three months.

- Write down everything you have spent money on.

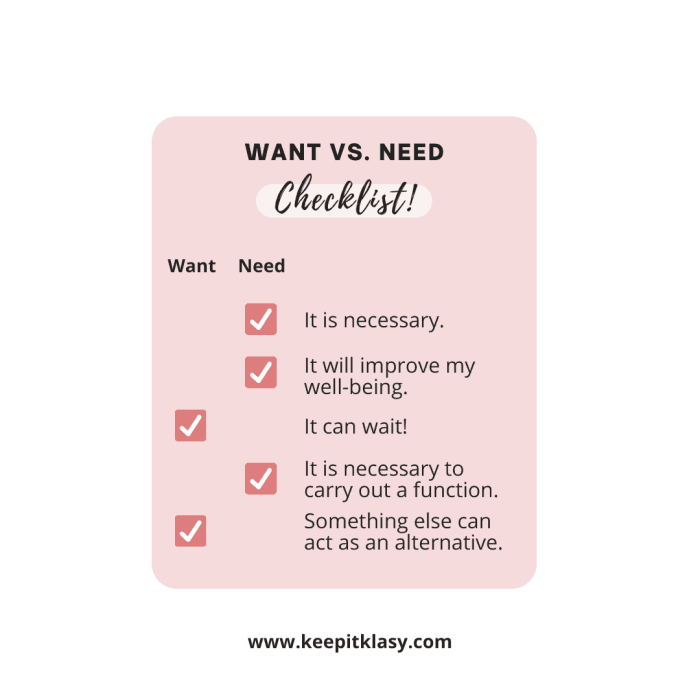

- Determine if this was a want or a need.

Things like weekly food shop is a definite need

5 Starbuck’s Lattes you could do without. Maybe cut these down by half and make your own coffee the remainder of the time.

Figure out why you bought these things.

- Did you for example feel pressure to buy coffee because your friend was getting one too?

- Did you buy that bag because you really needed one or because you were having a bad day?

Spending can be linked to our emotional states so get in touch with your emotions too.

The item you bought, did it add meaning to your life, and for how long? Did it help to solve your problems?

Track your spending from now on.

Get into the habit of looking at your balance more often. Regularly calculate if you are within your weekly and monthly budget. Take time to think before making a purchase.

STEP 3: Identify where you can save money.

As you are going through STEP 2 try to start identifying where you can save money. It might not be possible and that is fine. But maybe there could be small changes you could make that in the long run will add up.

For example, consider the supermarket where you shop. Is there a cheaper supermarket nearby with better deals?

Eat at home more often and try to plan your meals. This way you can make a shopping list and only buy the things you really need.

It will also help to avoid having to pop to the supermarket during the week. How many times did you go in to buy one item and come out with 10 items and £20 less in your bank account?

Make coffee and lunches at home.

Unsubscribe from any subscription if at all possible.

These are small changes but believe me, they do add up.

STEP 4: Set priorities.

When it comes to your finances you have to be able to set your priorities. Whatever your salary is, there will always be expenses and you will have to prioritise what to spend your money on.

Short-term and long-term budget management.

Budget management is crucial, and you have to look ahead of time to decide if there is a costly expense in the future that you will need to save some money for now. Think about your short-term priorities and long-term priorities and short-term and long-term expenses.

- Short term priorities/ expenses: girls night out, birthday party, work due

- Long term priorities/ expenses: Christmas, holiday, saving for a house, wedding

The long-term expenses are often more costly, and it might be the case that you will have to cut down on short-term expenses to be able to afford them. For example, you can’t miss a wedding but can miss one or two girls’ nights out. You can also compromise on these short-term expenses by for example inviting your friends for a girls’ night in instead.

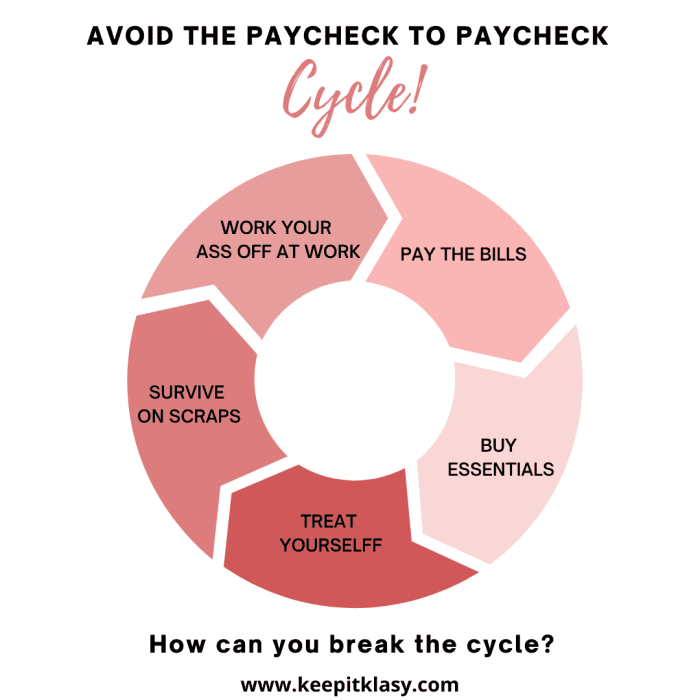

Get over FOMO.

FOMO – fear of missing out. Every millennial’s worst nightmare. Social media has been the biggest driver of FOMO. As you watch your friends post the most interesting and happiest moments of their lives, you start to get that lump in your stomach. You begin to revaluate your life and do everything you can to try to keep up with them.

Do not fall for this trap.

Remember that behind the façade of social media you really do not know what that friend’s life looks like. Their social media presence might be completely different from the reality in which they live.

So learn to say no from time to time to keep your finances in check.

And remember your long-term financial goals, the dream life you are investing in, and what your life could be if you just hold off the instant gratification now.

STEP 5: Staying on track for budgeting.

So far, you’ve identified your budget, you’ve assessed your expenses, and found a way to save money. Now you want to make sure you can stay on track with your financial goals in the long run.

Whenever you are purchasing something decide is it a want or a need.

Identify and stop impulse shopping or emotional spending.

The only way to stop this is to be 100% honest with yourself. If you are spending money to deal with any uncomfortable emotions or other problems in your life, spending money won’t fix it. It can do the opposite and create financial problems which will make you feel even worse. Identify the triggers and find ways to combat them.

Keep educating yourself about finances.

I recommend the following:

Books:

- How to Budget & Manage Your Money: Financial Planning Book for Beginners.

- How to Budget: Control Your Money Before It Controls You.

- How To Budget For Young Adults: A Practical Guide.

- How to Invest in the Stock Market: The Complete Guide for Beginners.

Podcasts:

- You Need A Budget (YNAB).

- Millennial Money Podcast.

- Journey To Launch.

- Money MD.

Review your balance.

Do this daily and review your bank statement monthly.

Create the right habits and get rid of the bad ones.

Too often people focus on building new and good habits but don’t forget you probably developed some bad habits too. Identify the bad habits around your spending and try to see how you can change them into new, good habits. Build on these new habits daily until you do them without even thinking about them.

Track your expense.

If you have a large, unexpected expense one month, you can cut down on your budget the following month.

STEP 6: Develop a positive money mindset.

A negative mindset around money can hold you back from attracting financial abundance into your life.

Get rid of these limiting beliefs:

- Having money makes you a bad person.

- Money is available, but not to me.

- I don’t spend that much.

- Budgeting is too time-consuming.

- I can only save£ 10 a month so there is no point.

- It is too difficult to earn passive income.

Positive money affirmations to change your mindset:

Set intention for budgeting.

What are your goals?

Why do you want to budget?

STEP 7: Find ways to earn more money

Go where money is.

If you want to earn more, you need to go where the money is.

This is a difficult truth, but too often it is overlooked.

Of course, it is not always as simple as that because there are certain barriers that we cannot simply put aside. If you have always worked in one field or line of work, it might be difficult to retrain in a more financially lucrative field for various reasons.

However, it can be worth re-evaluating where you are at and doing some research because in every area of work/field there could be opportunities to make extra income if you are clever about it.

Consider a side hustle.

Ok so in reality a side-hustle is not a get-rich-quick scheme. It will not save you financially right now. But if you invest in something now and stay consistent with it for 2 years, I promise you that your life is going to change! Remember to put off instant gratification and learn the skill of patience. It pays off! Can you imagine having passive income and never having money worries? 2-years is nothing when this is the ultimate reward.

Read my post on why you need a side hustle to find out more.

Invest.

Now I cannot say that I am the most knowledgeable person on this topic at all. But I am constantly making the effort to get to grips with ways to invest such as the stock market or properties. For now, I am educating myself on the topic so hopefully, when I am in a position to invest I can make smart decisions.

Why invest?

Inflation!

Inflation is:

‘A general increase in prices and fall in the purchasing value of money’.

This is why in the 80’s going to the cinema cost £1.88 and now it costs around £9

If you simply have money sitting around in your bank account, you are getting poorer every year because of inflation. The value of that money decreases. Even if the interest on that sum of money is 1%, the inflation rate will be much higher e.g., 3%. Over the year you are getting 2% poorer.

So if you do happen to have a chunk of money in your savings, the best thing you can do is invest it!

Declutter and sell items.

Look through your old clothing and see if there is anything you can sell that you no longer want. You can pretty much do this with anything. Nowadays there are so many possibilities to sell items online…

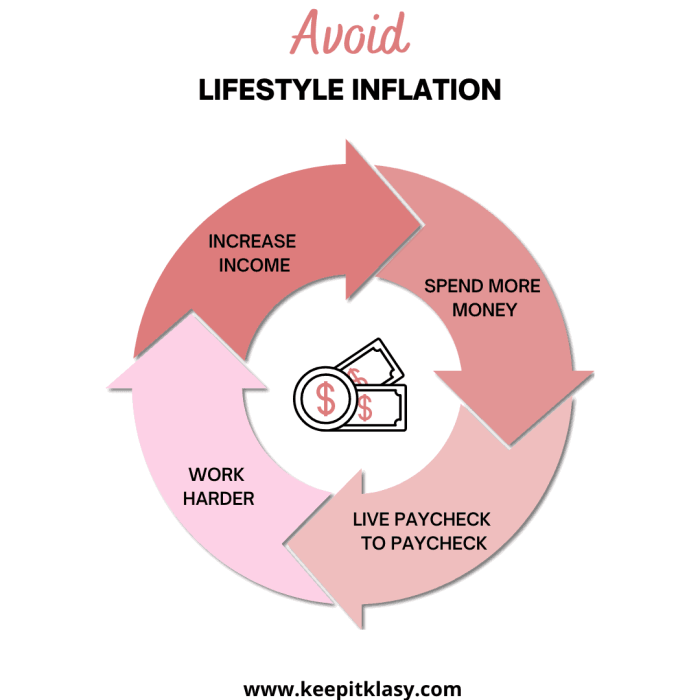

Do not fall for lifestyle inflation.

Lifestyle inflation refers to the phenomenon that as you start earning more, you start to elevate your standard of living. You spend more money on things because you can. Despite earning more money, you are still left with the same amount of money at the end of the month. You might find you still struggle to afford your wants and needs! Be careful because lifestyle inflation can easily sneak up on you.

How to avoid Lifestyle inflation:

- Keep creating a reasonable budget.

- Beware of your spending choices.

- Add changes to your budget gradually.

- Stop trying to impress others.

- Keep putting part of your income into your savings i.e., pay yourself first.

- Stop the entitlement mindset – there is no need for a fancier car if you are already happy with the one you’ve got.

- Do not spend time with big spenders.

- Teat yourself within reason.

On a Final Note.

Being financially savvy is truly one of the most valuable skills you can learn as a young woman, a young professional, and as a Girl Boss.

Learn to be smart with your money now, learn all about the potential money holds, learn to avoid common financial pitfalls. This way you’ll be on your way to ultimate financial abundance and freedom!

Knowledge and application of that knowledge are key.

I hope this post will be the first step in your journey!

Sending lots of positive vibes your way…

Natasza

xxx