There are so many misconceptions about rich people and how they build wealth. So often the idea of building wealth feels so far-fetched and out of reach, however, building wealth is very much possible for anybody. It is all about having the right knowledge, having the right mindset, and adopting certain habits.

I created this post to highlight to you the proven habits that have allowed the many rich people in this world to build their wealth and enjoy a life of freedom.

It is by no means an easy or a quick journey, which is why so few end up being rich and wealthy. It can be uncomfortable and often requires short-term sacrifices for long-term gains. However, if you can get behind some of the concepts then you will have the necessary wisdom, that few people possess. It will allow you to have a chance at living a life that few people in this world can enjoy.

Before we dive in further I wanted to define what we mean by simply rich people and rich people who are wealthy and highlight the difference between the two.

Disclaimer: This site contains affiliate links to products. We may receive a commission for purchases made through these links. Visit my disclaimer page for more information.

Rich vs. wealthy? What is the difference?

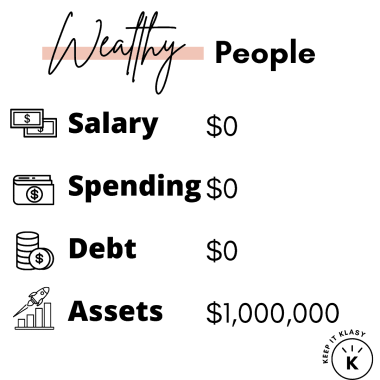

Rich people.

A person’s level of being rich is simply measured by how much he or she earns. Rich people simply make a lot of money by working in their full-time job. They always exchange time for money. They have little free time because in order to earn more they have to work long hours. A rich person might still be in debt and be broke because they spend money on things that are beyond their means. They buy liabilities that end up costing their whole salary because they want to display the amount of money they have.

Wealthy people.

A wealthy person is rich but their wealth is not measured by how much they actively make in their job. Instead, it is measured by how much time their money can buy them. Wealthy people invest in assets such as real estate, stocks, royalties and create passive income streams. They buy assets rather than liabilities such as the next best car, a bigger house, more gadgets, and material goods as these are a money black hole. They make sure that the money they make generates more money. Their assets provide them enough cash flow that they don’t have to work in a full-time job actively.

#1 They have a strong work ethic.

The honest truth – building wealth takes a lot of work and time. Whether you are thinking of going down the entrepreneur path or whether you are building your career, you will need a strong work ethic to get there.

A strong work ethic is the essence of productivity, especially on days, you do not feel like working or giving it your all. If you can be productive on those days and continually work on you goals and ambitions, there is no reason why you can’t achieve all you want. Imagine if you just gave up working altogether, on days you did not feel like working? How much longer would it take you to achieve it?

People who build wealth typically worked very hard and made the necessary sacrifices for a relatively short part of their lives in order to have long-term financial gains and freedom.

#2 They are willing to learn.

Firstly, they are willing to learn from their mistakes. That means accepting the mistake for being a mistake, accepting the fact that they were wrong, and taking responsibility. Only then is it possible to ensure you do not make the same mistake again? With finances or otherwise. On your journey to building wealth, you will not always make the best judgments. You may make a mistake but remember that doing it the second time becomes a choice.

Secondly, they listen to others’ opinions closely, without the need to always be right. They know that others may hold more knowledge and experience and have the answer. Hearing about other people’s experiences is one of the best ways to learn. I recommend reading books by people who made it and built their wealth. Or read blog posts and join communities where you can learn from women who are just that one step ahead of you and can help you make your next step.

#3 They stay humble.

Staying humble is what will help you build wealth and keep it. You hear the stories so often of people making it big and throwing all their money down the drain. Money can be a dangerous tool but it should not be defined that way. Because deep down it all depends on whose hands it finds itself in.

Money in the hands of a humble person will be used for the right purposes. If you can remain humble as you build your wealth, and not allow the money to define WHO YOU ARE as a person then you are safe.

Instead, use that money, invest it so that it can bring you more income and more freedom for you and those close to you.

#4 They invest money.

The last point brings me to this one. Rich people, understand that money can go as fast as it came. Therefore, the moment they make enough money, they don’t spend it. Instead, they re-invest it.

Investing money allows money to do the work for you. There are a number of ways you can invest it. It could mean putting it back into your business so that you can grow it further. It could mean investing in further education so that you acquire more skills that can help you make more money down the line. It could mean investing in properties or stocks.

All these ways will help you continually build wealth. It is such a simple concept yet very few people are willing to do this because they are not willing to think long-term.

Being able to detach yourself from the money you make, by not giving into lifestyle inflation and instead investing it, is the ultimate way to build wealth. Think complete financial freedom and more importantly time freedom!

#5 They have the right mindset.

The common Money Limiting beliefs that will hold you back:

- Money is scarce

- I am not worthy of having money

- You need money to make money

- Having money is selfish

- I am not good with money

- Money does not buy happiness

All these beliefs can hold you back – but what is more important is that they are not necessarily true.

I think, we women, are especially susceptible to holding these limiting money mindsets. I also think that is largely to do with how only recently we started to become financially independent. It still feels so fresh and therefore in some way wrong. It is time to change that. All women are worthy of making money and being able to provide for themselves.

With regards to money and happiness as Robert Kiyosaki once said – “Money is not the most important thing in life, but it does affect everything that is important”. I completely agree! It affects your education, your stress levels, the food you eat and therefore even impacting on your health, your access to healthcare, your lifestyle, your hobbies and therefore opportunities, and so many other small things that are so freaking important in life.

There is nothing wrong with having money. However, money does have a tendency to bring out people’s true colors. So having money itself does not make you a bad person, if you are not a bad person at the core.

Get rid of these misconceptions and never feel ashamed of having a money-focused mindset.

#6 They have an emergency fund.

Life has a funny way of testing us, and ironically, often in the worst possible moments.

Life is also very unpredictable, however, having an emergency fund can help you get through any difficult moments with less stress.

Start putting a small amount of your earnings towards your savings. It does not have to be a big amount, even if it is £10 a month. It will add up and you might be glad you have that extra cash when you need to for example make an unexpected purchase.

#7 They don’t make impulsive purchases.

Think through your purchases before you make them. If you want to buy something, put it off for a day or two and see if your mind has changed then – you might even forget about it in that time.

Before purchasing anything check your finances and make sure you can in fact afford it and how it will impact you. Will it mean having to give up on something else? Will it mean paying it off for the next year or so? Is it really worth it?

A lot of impulse purchases have an emotional basis underlying them. It could be a way of dealing with uncomfortable emotions or situations. Being aware of this and being honest with yourself can truly save your finances. Giving into emotional purchasing can be dangerous as it can become an addictive way of coping, yet a very ineffective way of coping. The purchase will not solve the core problem and your finances could suffer as well. The only way to solve it is to work through the core issue.

Take time to think before spending your money and be sensible about it.

#8 They do their best to avoid debt.

I say do their best here because I understand that sometimes, circumstances align in a way that taking out loans is really the only option. This can happen to anyone and everyone and there is nothing wrong with that.

What I am referring to here, is the importance of not living above your means. In some cases, loans and debts are created out of necessity. However, equally a lot of the time they are created because people try to live a lifestyle that they cannot afford. This is such a dangerous situation to be in and it can very quickly spiral out of control.

Avoid getting into this situation. Live within your means and if you want a life upgrade, find ways in which that can be achieved.

#9 They believe wealth is made not inherited.

Your background does not define your future. You absolutely have the power to change that. If you do want to change that, you have to accept that it is possible. Being open to the idea that you can build wealth even if you are the first in your family to do so is crucial. Only then will you begin making the choices that will lead you there.

Limiting beliefs about money can hold you back. If you believe you will never make it, you will never have the determination to try anything that could get you there. If you believe that you can make wealth and financial stability, you will be open to and even seek out all the opportunities that could open that door for you.

#10 They plan ahead.

You cannot predict anything in life with any sort of guarantee, but you can put things in place that could minimise any impacts of challenging situations – especially financial ones.

I think especially when we are young, we very much focus on the here and now. But having the ability to think a little bit about the future from young adulthood can change the trajectory of your life down the line.

Educate yourself about finances, about mortgages, buying properties, about investing, about pensions, and about saving from as early as possible. Knowing about these things will help you make the right financial choices now, which you will be thanking yourself for later in life.

#11 They spend less than they make.

This point goes beyond living within your means to avoid debt. It means taking your lifestyle down even further so that you live below your means. This is not easy but if you do that for a short period of time, and save or invest that extra money, you could be living with much greater financial freedom soon after.

Imagine having that emergency fund. Imagine putting down a deposit for that house. Imagine paying off your debt. Imagine investing and seeing your money grow on its own. Imagine being able to start that business you have wanted to.

Think short-term sacrifices for long-term gains…

#12 They know their true passion.

Do not aimlessly follow the crowd. Society often defines for us what our life should be, what we should want out of life, and what we need. It happens on such a mass level, that very few people stop to question if maybe there is another way to live? We just assume that that is the only way because after all, everyone else is doing it right?

Be one of the 2% that do ask the question – Is there another way?

If you were to remove all the society and family expectations, what would you be doing? What is your true passion?

You get one life – set your own rules and define how you wish to live your life. Then do everything you can to make it happen. It is scary and it takes a lot but living out your true self – you’ll never regret that.

#13 They are patient.

Nothing worthwhile comes easily. This is why so few get to enjoy the life they truly want.

Patience is the secret of people who do succeed in their dreams and build wealth and a life of freedom. They were patient, persistent, and consistent with their goals.

They did not give in to the falsehood of overnight success. They continued working for years before they finally saw a glimpse of hope that it might work out.

The same amount of time will pass, whether you continue working on your goals or not. You will turn 30, 35, 40 in 5 years’ time whether you succeed in business or not, so you might as well go for it! Continue working on it, because the ability to be patient and therefore consistent, especially when you feel like giving up, is the key to every successful person’s success. It is what allows them to build wealth and the freedom that comes with it.

But it is not for the faint-hearted.

#14 They have multiple sources of income.

Having only one source of income is so risky. It is like walking on a frozen lake. The layer of ice is the only thing between you and the freezing water underneath. You have little knowledge and control of how thin or thick the ice is that you are walking on. It could crack at any moment, and you could drown.

Don’t fall into the complacency that your job is secure. Everything could change overnight.

Having those extra sources of income is like a lifeboat. They will keep you afloat during the tough times and during the good times, you can invest the money to work towards building your wealth.

#15 They believe anybody can be rich.

This is the mindset of rich people. They do not limit themselves in any way. They do not put barriers that might prevent them from taking those opportunities. They do not let their past define what their future could be. They have a vision, and they go for it!

On a final note.

Anybody can become wealthy. But in order to be rich and have wealth, you need to learn what rich people do differently, how they think, and the kind of choices they make, especially early on in their adult lives. I hope this post has helped you see a bit better what it takes. I hope it shows you the steps and mindset shift of rich people you can work on to get there too – you just have to believe that you are worthy and you can!

To summaries – The 15 habits of rich people that help them build wealth:

#1 They have a strong work ethic.

#2 They are willing to learn.

#3 They stay humble.

#4 They invest money.

#5 They have the right mindset.

#6 They have an emergency fund.

#7 They don’t make impulsive purchases.

#8 They do their best to avoid debt.

#9 They believe wealth is made not inherited

#10 They plan ahead.

#11 They spend less than they make.

#12 They know their true passion.

#13 They are patient

#14 They have multiple sources of income.

#15 They believe anybody can be rich.